Self-Service Banking Kiosks: The Future

WRITTEN BY: TelemetryTV, 03-04-2025

The way we interact with banks continues to evolve at a rapid pace. Today’s digitally oriented banking customers expect convenience, control, and personalization in every transaction. One technology meeting these demands is the self-service banking kiosk. From speeding up in-branch workflows to providing secure 24/7 banking services, these kiosks are reshaping how customers engage with their financial institutions.

The Evolution of Self-Service in Banking

The concept of self-service in banking has been evolving ever since the introduction of ATMs. However, modern kiosks go far beyond basic cash withdrawals. By integrating advanced features and custom apps, these solutions reduce wait times, support personalized services, and deliver greater privacy—all while meeting rising customer expectations.

Transition from ATMs to Kiosks

While ATMs were the original step toward self service banking, their functionality was largely limited to cash transactions. Today’s bank self service kiosk can handle a wider range of tasks, from deposits and fund transfers to paying bills or even opening new accounts. Many of these banking kiosks also leverage computer vision, sensors, and edge AI for privacy, providing advanced security and customized interactions.

Emergence of Personal Teller Machines (PTM)

A breakthrough addition to the self-service kiosk landscape is the Personal Teller Machine (PTM). This self-service terminal empowers customers to manage a full suite of teller services unassisted, from deposits to check cashing. Nowadays, PTMs often integrate advanced authentication and AI-driven features, further enhancing the bank kiosk user experience.

The Benefits of Self-Service Kiosks in Banks and Credit Unions

Embracing bank kiosks brings a host of advantages: improved operational efficiency, reduced costs, enhanced customer experiences, and broader service availability, all critical in the evolving bank kiosk market.

Operational Efficiency

By offloading routine tasks to self-service kiosks, bank employees are freed to address more complex customer needs. Modern kiosks often feature custom applications that guide users step by step, bolstering the overall efficiency of branch operations.

Cost Savings

Through self-service banking kiosks, banks can optimize staffing levels and reduce overhead. The hardware and maintenance expenses of kiosks are typically lower than those of full-service branches. Additionally, centralizing support for multiple kiosks allows for streamlined operations.

Improved Customer Experience

A bank self service kiosk offers faster and more convenient transactions, helping customers avoid queues and complete banking tasks on their own schedule. Integrations with advanced sensors and edge AI further personalize services while maintaining robust security.

Extended Service Hours

High-tech banking kiosks can operate 24/7, providing services well beyond typical branch hours. This around-the-clock availability is crucial in locations or markets where keeping branches open long-term is not economically feasible.

Types of Self-Service Kiosks in Banking

Modern self-service kiosks are versatile, coming in several forms that cater to diverse banking needs.

Banking Kiosk Solutions

These solutions handle an extensive set of transactions, ranging from balance inquiries to check scanning. As technology advances, many include custom web apps and computer vision for secure authentication, making them indispensable both on-site and off-site.

Virtual Teller Agents

Virtual teller agents connect customers with remote banking experts via two-way video. This model lowers staffing costs while providing real-time human assistance whenever needed, effectively expanding services into new areas without building a physical branch.

Interactive Kiosk Displays

Interactive displays combine content delivery with user engagement. Many banking kiosks now support custom apps, guiding customers through tasks such as loan applications, product comparisons, or complex financial planning—all via a straightforward interface.

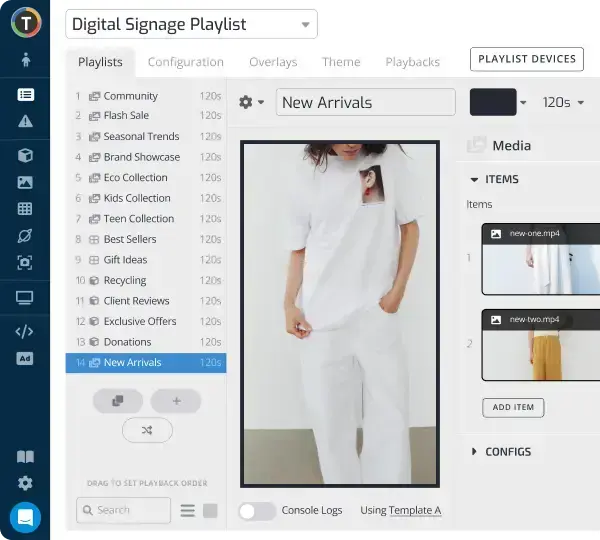

Digital Signage Kiosks

From showcasing rates and promotions to handling basic banking tasks, digital signage kiosks replace paper materials with dynamic content. By integrating sensors and AI, banks can tailor messaging and services, ensuring a relevant and secure experience for each user.

Integrating Self-service Kiosks into the Branch Model

Effectively embedding self-service kiosks within the traditional bank branch is key to maximizing their potential. Proper planning regarding location, usability, security, and maintenance is crucial.

Location and Accessibility

Positioning kiosks in convenient, high-traffic areas—inside or outside the branch—ensures easy access for customers. Deploying them at shopping centers, airports, or community hubs not only boosts visibility but also accelerates growth in the bank kiosk market.

User Experience

A kiosk’s success hinges on ease of use. Clear prompts, an intuitive interface, and seamless integration with digital banking platforms and custom apps help ensure a positive user experience and high adoption rates.

Security

Given the sensitivity of financial data, self-service kiosks must incorporate sophisticated security layers, including encryption, biometric authentication, and advanced monitoring. By leveraging sensors and edge AI, banks maintain customer trust and protect against fraud.

Support and Maintenance

Like any essential technology, kiosks require proactive upkeep. From software updates to routine hardware checks, banks should have a clear maintenance strategy. Remote monitoring can help preemptively address issues before they disrupt services.

The Future of Self-service Kiosks in Banking

With the rapid progression of digital banking, self-service banking kiosks will continue to play a pivotal role. Innovations such as biometric identification, voice assistance, and advanced analytics promise even more personalized experiences. Additionally, expanding support for custom applications gives banks a competitive edge, enabling them to refine kiosk functionality for specialized customer segments.

The financial sector has embraced these technological leaps, and the consensus is clear—self-service kiosks are not just a passing trend but a mainstay of modern banking. By investing in these solutions and integrating them effectively, banks can remain competitive and meet customer expectations now and beyond.

Get Started with Kiosks Now

Think a digital kiosk is right for your business? The right software platform is essential to power computer vision, sensor integration, and custom apps—all while ensuring robust security and reliability.

That’s where TelemetryTV excels. We’re the digital signage and kiosk experts trusted by industry leaders such as BCG, Starbucks, and Stanford Medicine for delivering innovative, secure, and user-friendly solutions.

Sign up for a free 30-day trial of TelemetryTV today to see firsthand how our platform handles digital kiosk deployments. Or, request a demo to learn how we can help manage your kiosk devices, content, and custom web applications.

Elevate Your Banking Kiosk Strategy with TelemetryTV

Enhance your self-service banking approach with advanced kiosk technology, powered by custom apps, sensors, and edge AI. Provide secure, convenient solutions that your customers trust.

Start for Free