Credit Union Marketing: Top 10 Ideas to Drive Growth

WRITTEN BY: TelemetryTV, 02-24-2025

Credit unions operate in an ever-shifting financial landscape, competing not only with traditional banks but also with fintechs appealing to younger audiences. To thrive, they need robust, forward-looking marketing strategies that blend digital innovation and community-centric values. Below, we explore the top 10 credit union marketing ideas to help institutions across the United States and Canada grow sustainably, followed by a closer look at how modern tools—particularly digital signage software—can elevate campaigns.

Top 10 Ideas for a Winning Credit Union Marketing Plan

1. Modernize with Digital Channels

Mobile and online banking have become table stakes, but many credit unions still lag in user experience. A core element of any credit union digital marketing plan is a frictionless digital environment: an intuitive mobile app, interactive website features, and self-service tools such as mobile check deposits. Recent data shows that about 8% of consumers leave their financial institution due to poor online or mobile services—underscoring why modernization is crucial.

2. Embrace AI and Personalization

Artificial intelligence has moved from buzzword to business reality. Credit unions can employ AI chatbots for 24/7 support, analyze transaction data for personalized offers, and leverage automated email or text outreach triggered by member behavior. A recent study found that nearly 45% of consumers might switch financial institutions for more tailored experiences, suggesting that personalization done right pays dividends in loyalty.

3. Strengthen Community Presence

Local sponsorships, volunteer initiatives, and events like neighborhood cleanup days reinforce a credit union’s core mission. Credit union marketing ideas centered around community not only boost brand goodwill but also help attract new members—particularly those seeking alternatives to large, impersonal institutions. Whether you sponsor a charity run or host an onsite shred day, make sure these efforts are integrated across social media, digital newsletters, and in-branch displays.

4. Invest in Financial Education

Offering seminars on budgeting, retirement planning, or credit building demonstrates genuine commitment to member well-being. Content marketing through blogs, webinars, or videos positions the credit union as a trusted financial partner. Such educational outreach also creates a pipeline for promoting relevant services (like first-time homebuyer loans) when members are ready.

5. Targeted Social Media and Video Campaigns

Social media is indispensable for credit union digital marketing. A strong presence on platforms such as Facebook, Instagram, and LinkedIn fosters two-way communication with members. Meanwhile, short-form videos on YouTube or TikTok can explain complex financial topics in an engaging manner. Even a modest increase in follower engagement can help prospective members view your institution as accessible and transparent.

6. Adopt an Omnichannel Approach

Members expect consistent experiences across websites, mobile apps, emails, branch visits, and even direct mail. Research shows that an integrated, omnichannel campaign can improve overall response rates by as much as 63%. For example, an auto-loan offer might appear in both your email newsletter and on a lobby display—ensuring no member misses out.

7. Refine On-Site Marketing

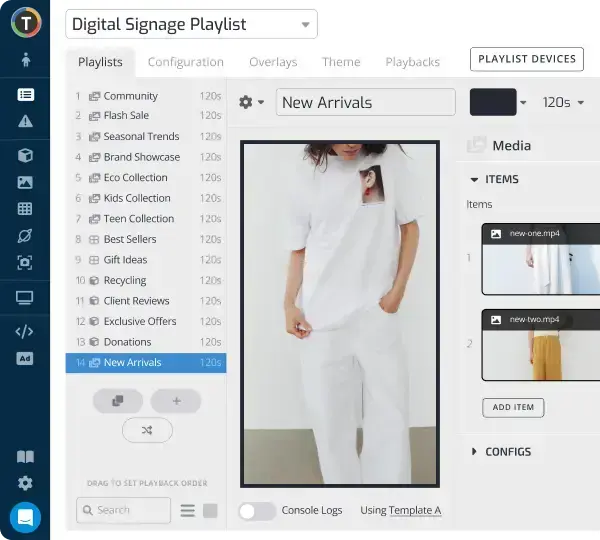

Despite the rise of online banking, physical branches remain important for complex services and personal consultations. Here, digital signage software can transform a waiting area into an informative, visually engaging environment. Instead of static posters, dynamic screens can rotate announcements about loan promotions, community events, and financial tips.

8. Make Onboarding and Upselling Seamless

A thoughtful onboarding sequence—via email or text—helps new members discover services they might otherwise overlook. Meanwhile, data-driven upselling is more relevant and less intrusive. If analytics reveal a member consistently maintains a high checking balance, your credit union might recommend a higher-yield share certificate. This approach deepens member relationships and boosts product adoption.

9. Incentivize Loyalty and Referrals

Referral programs, where existing members receive rewards for bringing new ones on board, are powerful in tight-knit communities. Gamification can also keep members engaged. For instance, awarding points for completing financial education modules or using certain digital tools can reinforce positive behaviors while subtly promoting other services.

10. Gather Data, Then Iterate

A strong credit union marketing plan relies on measurable KPIs—engagement rates, product adoption, or net promoter scores. Gather data from digital platforms, in-branch surveys, and CRM systems, then adjust strategies accordingly. Continual iteration, guided by real-world results, helps allocate budget more effectively and fosters sustained growth.

Why Digital Signage Software Matters

Among the varied tactics in credit union marketing, digital signage stands out for bridging the gap between online and offline efforts. A single cloud-based platform can deliver timely announcements, highlight new services, and unify campaigns across multiple branches.

Greater Engagement and Operational Efficiency

Studies show that digital signage can more than double ad recall compared to static posters. Because displays are dynamic and visually appealing, members take note of promotions—whether for mortgages, credit cards, or community events. Centralizing content management through TelemetryTV’s SOC 2 compliant digital signage software lets marketing teams instantly update displays, schedule campaigns, and ensure uniform branding across branches.

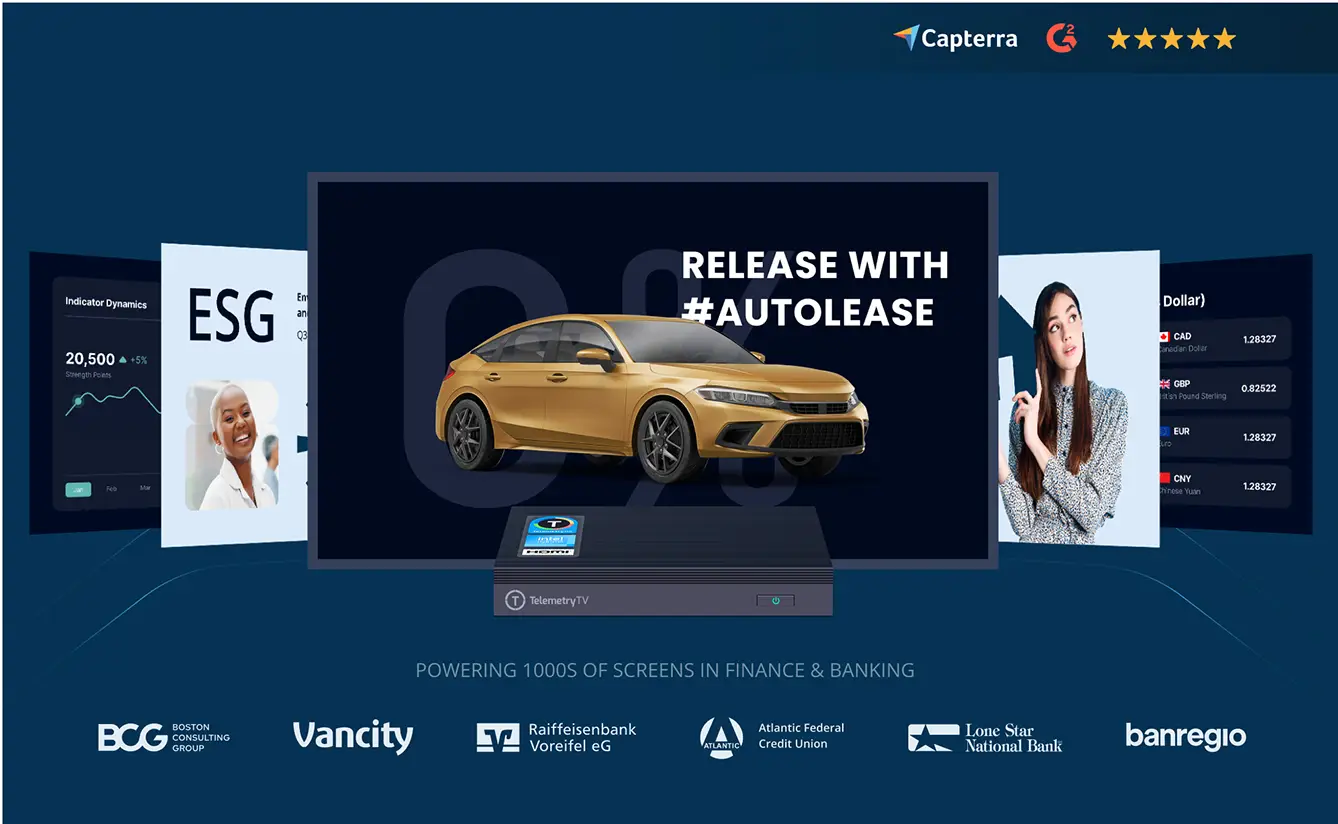

A Closer Look at TelemetryTV

Credit unions such as Vancouver City Savings Credit Union (Vancity) have modernized their in-branch experience using TelemetryTV’s digital signage software. After migrating, Vancity noticed streamlined content deployment, rapid updates, and greater visitor engagement with promotional messages. TelemetryTV’s capabilities include remote monitoring, real-time device health checks, and automation features that reduce the burden on IT teams.

Other notable organizations—including BCG, Atlantic Credit Union, and 1st Choice Savings—use TelemetryTV to handle content at scale. Whether you manage 5 screens or 500, the platform’s cloud-based architecture and security credentials ensure smooth operation, a critical requirement in the highly regulated financial sector.

Quick Benchmarks and ROI Insights

Below is a concise look at selected metrics that matter to credit unions aiming to maximize marketing ROI:

| Strategy | Average ROI | Key Insight |

|---|---|---|

| Direct Mail | ~112% | High open rates; best when paired with digital |

| Email Marketing | ~93% | Automation and personalization boost conversions |

| Digital Signage Campaigns | Up to 2x ad recall | Dynamic content fosters stronger brand visibility |

Sources: Various marketing surveys (2023–2024 data)

Crafting an Effective Credit Union Marketing Plan

Developing a comprehensive plan for the coming year hinges on three core principles:

1. Member-Centricity – Use data-driven insights to tailor messaging and deliver genuine financial education.

2. Omnichannel Consistency – Unite digital, offline, and on-site efforts so that every interaction feels cohesive.

3. Continuous Innovation – Adopt emerging tools (AI-driven personalization, digital signage software) to stay ahead of consumer expectations.

Conclusion and Next Steps

In an era defined by fintech disruptors and evolving member expectations, credit union marketing demands both creativity and technological prowess. A well-crafted strategy should capture the timeless community spirit that sets credit unions apart, but also leverage cutting-edge tools to streamline outreach and enhance experiences.

By deploying solutions that merge physical and digital realms—whether through AI, social media, or dynamic signage—credit unions can strengthen member trust, grow their footprint, and continue serving communities with personalized financial solutions well into 2025 and beyond.

Elevate Branch Marketing with TelemetryTV

Upgrade your branch marketing with TelemetryTV’s digital signage software. Enjoy effortless content management, SOC 2-level security, and unified messaging that boosts member engagement and growth across all locations.

Start for Free