ROI of Bank Digital Signage: A Cost-Benefit Analysis for Multi-Branch Networks

WRITTEN BY: TelemetryTV, 02-18-2025

Banks and credit unions with 10s of locations are increasingly turning to bank digital signage to modernize their branches and improve customer experience. But is the investment worth it? This fact-driven analysis examines the return on investment (ROI) of digital signage in the finance sector, breaking down costs and highlighting revenue impacts. We’ll also look at real-world case studies (Vancity and Lone Star) to see how cloud-based digital signage software solutions like TelemetryTV deliver value.

By the end, it’s clear that digital displays can pay for themselves quickly—often in under two years—by reducing operational costs and boosting sales and customer loyalty. And with TelemetryTV’s platform enabling easy management and low-maintenance hardware, the ROI becomes even more attractive.

Cost Breakdown: Upfront Investment vs Ongoing Costs

Implementing digital signage in bank branches involves some upfront costs, but these are offset by savings over time. Let’s break down the key components:

• Display Screens: Modern commercial-grade screens (LED/LCD displays) form the backbone of any digital signage deployment. A typical branch might install one or several large displays in the lobby or waiting area. Decent 43–55” displays can range from a few hundred dollars to a couple thousand each, depending on size and features.

• Media Player Hardware: Each screen (or set of screens) needs a media player device to run content. Banks can choose compact digital signage players or even use small PCs. TelemetryTV’s TelemetryOS Box is a cost-efficient option—at roughly $299 per unit, it supports up to three 4K displays from one device, effectively lowering the hardware count for multi-screen setups. These players connect to the cloud-based CMS and store/cache content locally. TelemetryOS Box is purpose-built for 24/7 signage use and engineered for reliability and performance. TelemetryTV’s user data shows TelemetryOS devices experience 67% less downtime and require 56% less maintenance time compared to typical alternatives, meaning lower IT labor costs and fewer site visits.

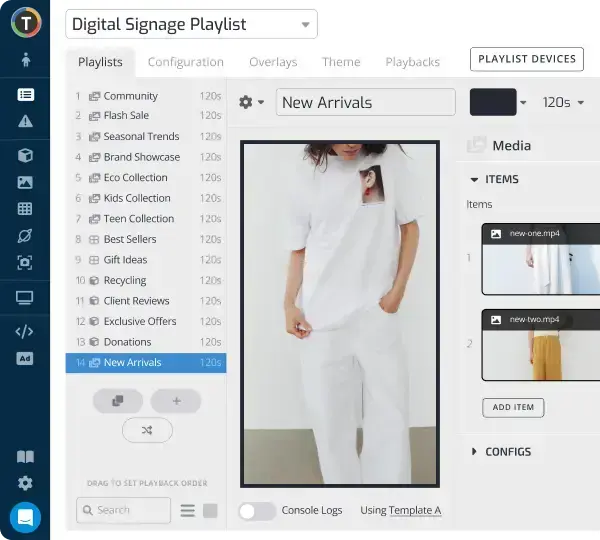

• Software (CMS) and Licenses: Running digital signs requires software to manage content. TelemetryTV’s cloud-based digital signage software allows banks to control all screens across all branches remotely via the internet. Cloud software is typically provided as a subscription (often per screen or per device). Because it’s cloud-based, there’s no need for on-premises servers, and updates/improvements are automatic.

• Installation & Setup: There will be one-time costs to install screens and players in each branch. These costs vary based on branch layout. Once installed, the system should run with minimal intervention. TelemetryTV’s hardware supports Recurring cost for posters, brochures, etc. like automatic provisioning. For instance, Vancity credit union was able to plug in their existing PCs and quickly install the TelemetryTV app, cutting their device provisioning time by 50% compared to their old system.

• Content Creation & Management: With digital signs, banks need content (promotional graphics, videos, announcements). This can incur costs via in-house design or outsourcing. However, digital content can be quickly updated, unlike printed posters that must be re-printed for every change.

• Ongoing Maintenance: Traditional static signage has lower direct maintenance but requires frequent printing and distribution of new posters. Digital signage shifts costs to maintaining screens and players. TelemetryOS devices install security patches automatically, reducing hands-on maintenance. Remote monitoring means issues can often be resolved without sending a technician on-site.

• Electricity & Connectivity: Digital screens consume power, so there’s a small utility cost. Modern LED backlighting is quite efficient. Internet connectivity is usually already in place at bank branches.

To visualize the cost differences, consider a comparison between traditional printed signage and a digital signage solution:

| Cost Factor | Traditional Print Signage | Digital Signage Solution |

|---|---|---|

| Printing & Materials | Recurring cost for printed materials. | Eliminated: No paper or ink needed—content is updated digitally. |

| Displays & Fixtures | Basic lightboxes. Low cost, but static. | High-quality screens (one-time). ~$500–$1,500 each. Dynamic visuals and long-term use. |

| Media Players | Not needed for static posters. | Compact device (e.g. TelemetryOS Box ~$299) can power 3 screens, reducing hardware count. |

| Installation | Manual change-outs. | Professional install for screens & wiring. After that, updates are remote. |

| Content Updates | High labor: design, printing, shipping, staff time to swap out materials. | Real-time updates: push content instantly via cloud (67% less maintenance time). |

| Ongoing Maintenance | Continual printing costs, disposal of old printed materials. | Software auto-updates, remote troubleshooting. Minimal physical maintenance. |

Moving to digital signage can cut print and admin costs by up to 50% in the long term. Banks also move closer to a paperless branch, where digital displays can handle everything from rate posters to form notices.

TelemetryTV’s cloud platform adds cost efficiency by centralizing management. Instead of each branch handling updates or sending IT staff onsite, everything is controlled from HQ. TelemetryTV allows scheduling content in advance and setting expiry times. Cached content prevents blank screens if connectivity drops. These features reduce maintenance to near-zero, reflected in a lower total cost of ownership.

For a mid-sized bank, an example investment might include 20 screens at $800 each = $16k, plus 7 media players at $300 each = $2.1k, plus $10k in installation. That’s roughly $28k upfront. Software licensing could add a few hundred per month. This investment often pays for itself in the first year through print savings and increased sales.

Revenue and Business Impact

While cost savings are one side of ROI, the other side is how digital signage boosts revenue and customer metrics. Banks deploy digital signage not just to save paper but to drive growth by enhancing the branch experience and strengthening customer relationships.

Enhanced Promotions and Product Sales

Branches are still critical sales points for banks. Digital signage turns those branch visits into opportunities by showcasing relevant products and timely messages with eye-catching visuals. Studies indicate digital signage attracts 400% more views than static displays, and recall rates can reach 83%. Customers are more likely to notice and remember a dynamic screen message than a static poster.

This increased engagement translates into higher conversion. Statistics show that 80% of brands using digital signage see an uptick in sales of their offerings. Even modest percentage gains can yield substantial revenue in a banking context. A 2–3% bump in product sign-ups or cross-sells quickly adds up.

For instance, consider a credit union with 20 branches that invests $50k in digital signage. If each branch’s screens convert just a few additional customers monthly—for a new credit card or loan—the annual revenue gains can meet or exceed the initial investment. Combined with print savings, the payback is often under two years.

Improved Customer Experience = Higher Retention and LTV

ROI isn’t only about immediate sales. It also includes the longer-term value of happy, engaged customers. Digital signage elevates the branch experience in several ways:

• Reduced Perceived Wait Times — Informative or entertaining screen content makes wait times feel shorter. Some banks report up to a 35% reduction in perceived wait time.

• Better Communication and Engagement — Banks can display financial tips, community news, or weather updates, keeping viewers engaged. Younger demographics especially appreciate modern, tech-savvy environments.

• Personalized, Localized Messaging — Content can be tailored per branch or location demographics. This relevancy increases customer satisfaction.

• Trust and Brand Reputation — Showing core values, security info, or community involvement on-screen can boost customer confidence. A more trusted, informed customer remains loyal longer and adopt more products.

Even preventing a modest number of defections to competitors can offset the signage investment. Loyal customers deepen their relationship over time, increasing lifetime value.

Comparing ROI: Digital Signage vs Traditional Printed Posters

Here’s a quick comparison of digital signage against old-fashioned static signage solutions:

| ROI Factor | Traditional Printed Signs | Digital Signage |

|---|---|---|

| Upfront Cost | Low (paper and frames) | Higher (screens, players, setup) |

| Ongoing Cost | High—continual reprinting, shipping, labor | Low—content updates are software-based |

| Attention & Recall | Limited; static visuals often ignored | High; 83% recall rate for digital content |

| Engagement & Conversions | Passive; relies on customer initiative | Dynamic; some see a 3% sales margin boost |

| Customer Experience | No effect on wait times or ambiance | Improves perceived wait time by ~35% |

| Agility of Messaging | Slow; weeks to roll out new campaigns | Real-time; instant updates across locations |

| ROI Payback | No capital investment, no cumulative returns | Often <18 months; long-term ROI can exceed 100% |

After the initial breakeven point (often one to two years), digital signage delivers net gains. Some businesses achieve payback in under 12 months, with ROI over 100% long term.

Real-World Results: Vancity and Lone Star Case Studies

Vancity Credit Union – 55 Locations in Vancouver, BC

Vancity is a large credit union with 55 retail branches. They chose TelemetryTV’s digital signage software after testing various solutions.

• Deployment & Scale — Vancity validated ROI in a pilot, then rolled out TelemetryTV on 120 screens across 55 locations. They repurposed existing Windows PCs as media players, simplifying the transition.

• Operational Impact — With a cloud-based system, Vancity’s marketing team can update branch content remotely. Remote monitoring and cached content reduce downtime, and provisioning time was cut in half.

• ROI & Reception — Though specific numbers weren’t shared publicly, Vancity cited “far-improved omnichannel marketing campaigns” and fewer IT headaches. Faster updates and engaging content translate to a strong ROI.

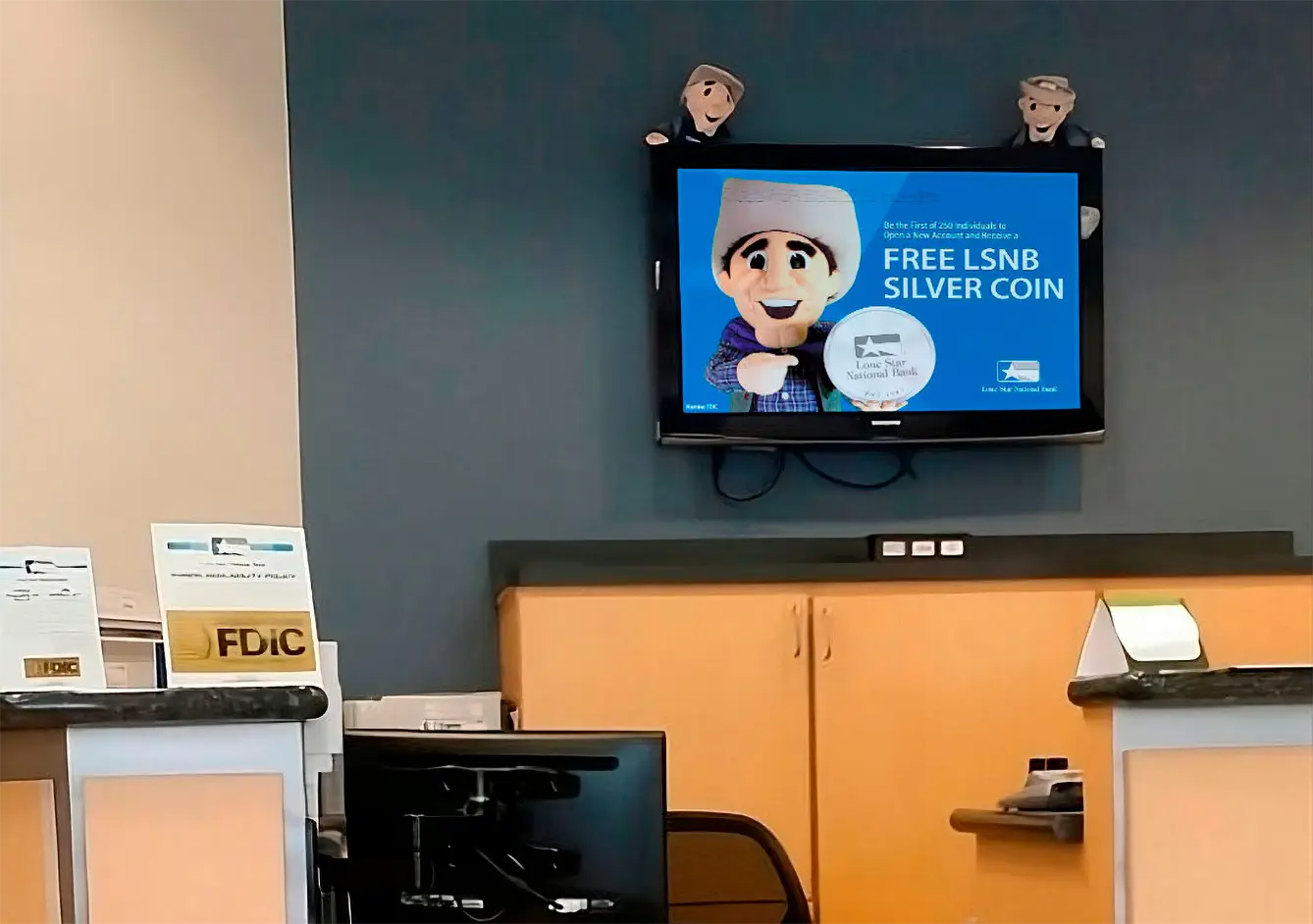

Lone Star National Bank – 40+ Texas Branches

Lone Star National Bank (LSNB) in Texas wanted to modernize branch marketing. They had used a mix of printed materials and basic TV displays.

• Goals and Challenges — LSNB needed a better way to promote new products, empower marketers to manage content, and reduce IT workloads.

• Solution & Features — They placed screens above teller lines and in lobbies to create an immersive experience. LSNB used tag-based playlists for branch-specific content and scheduled promotions to automatically appear or expire.

• Efficiency Gains — TelemetryTV’s automatic device provisioning let LSNB deploy and oversee network health with minimal IT labor. Campaigns that once took weeks now launch bank-wide in seconds.

• Results — LSNB effectively stopped using static posters, saving print costs and boosting marketing agility. While exact ROI figures weren’t disclosed, the combined cost savings and promotional benefits point to a strong return.

Conclusion: Calculating the ROI

For banks and credit unions with 10s of branches, the evidence is clear: digital signage is a high-ROI investment. By replacing static signs with dynamic digital displays, banks unlock:

• Cost Savings — Significant reduction in printing, logistics, and labor. TelemetryTV plus TelemetryOS Box minimize tech maintenance.

• Revenue Increases — Uplifts in product sales, cross-sells, and service uptake through more effective branch marketing.

• Customer Experience Improvements — Shorter perceived wait times, targeted messaging, and modern design all drive loyalty and lifetime value.

• Strategic Agility — Instant rollout of messaging across branches for timely rate changes, promotions, or community updates. Absolutely crucial in a rapidly evolving market.

Banks should consider both direct returns (cost savings and incremental sales) and indirect returns (brand image, customer retention). Many see payback in under two years. With TelemetryTV, advanced features like cloud-based control and reliable hardware tilt the ROI equation strongly in favor of digital signage.

If your bank wants to reduce costs and boost engagement, now is the time to go digital. TelemetryTV’s cloud-based digital signage software provides an enterprise-grade solution. Start for Free today and see how modern digital signage transforms your branches and drives growth.

Ready to Upgrade Your Branch Experience?

Discover how TelemetryTV’s digital signage software delivers high-impact content, better engagement, and measurable ROI. Join leading banks upgrading their branch marketing today.

Start for Free